Business Insurance in and around Camillus

Calling all small business owners of Camillus!

No funny business here

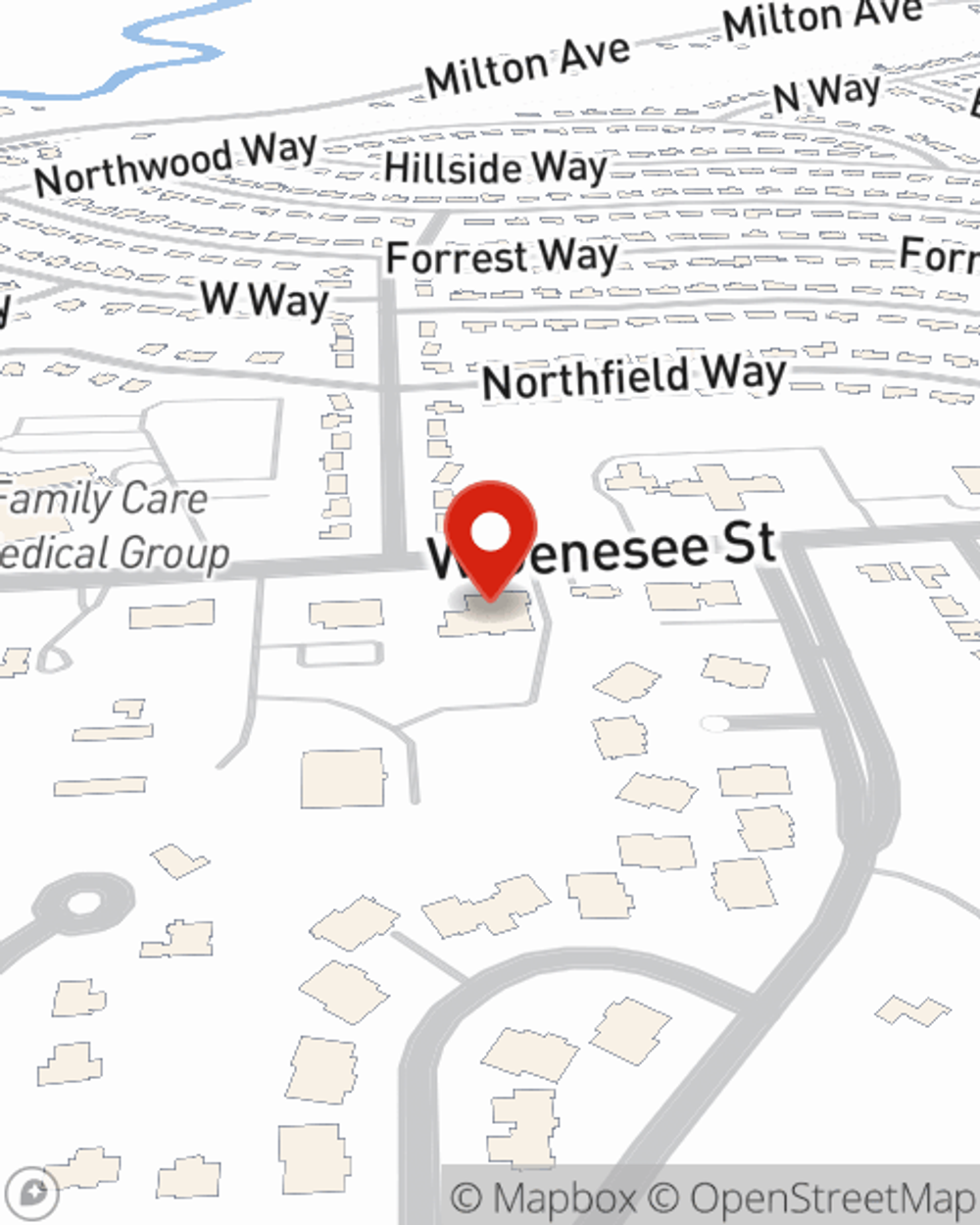

- Camillus, NY

- Solvay, NY

- Marcellus, NY

- Fairmount, NY

- Skaneateles, NY

- Onondaga County

- Baldwinsville, NY

- Jordan, NY

- Central NY

This Coverage Is Worth It.

Running a small business is hard work. Getting the right insurance should be the least of your worries. State Farm insures small businesses that fall under the umbrella of contractors, trades, retailers and more!

Calling all small business owners of Camillus!

No funny business here

Strictly Business With State Farm

You are dedicated to your small business like State Farm is dedicated to reliable insurance. That's why it only makes sense to check out their coverage offerings for builders risk insurance, artisan and service contractors or worker’s compensation.

With over 300+ businesses eligible to be insured by State Farm, look no further for your business coverage needs. Agent Andrew Cambria is here to help you explore your options. Get in touch today!

Simple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

How to do small business inventory

How to do small business inventory

Learn more about small business inventory, including types, tracking tools and strategies to help your business succeed.

Andrew Cambria

State Farm® Insurance AgentSimple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

How to do small business inventory

How to do small business inventory

Learn more about small business inventory, including types, tracking tools and strategies to help your business succeed.